For Western Balkan countries, aspirations to join the European Union (EU) mean there is an urgent need to align with the bloc’s climate and environmental policy acquis. The six Western Balkans countries (the BM6) – Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia and Serbia – approved the Sofia Declaration in 2020 and thus committed to a common green agenda aligned with the EU Green Deal, including the implementation of a carbon pricing instrument.

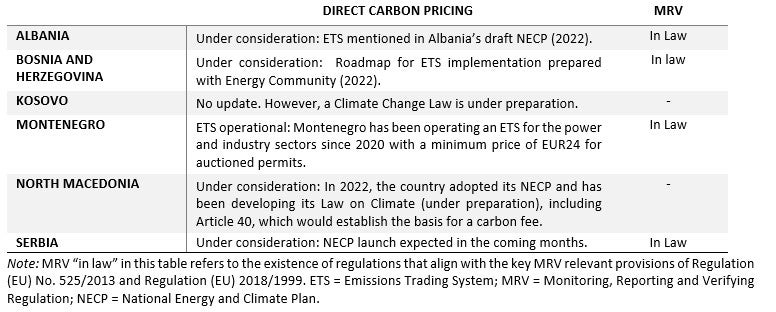

Since then, progress on carbon pricing has been limited, but the subject appears to be high on the government’s agenda, as analyzed in the latest edition of the report. Regular economic report on the Western Balkans. The Sofia Declaration was followed by the Roadmap for decarbonization under the Energy Community in 2021, which included carbon pricing, as well as roadmap for the implementation of the Green Agenda. Most BM6 countries have since implemented greenhouse gas emissions monitoring, reporting and verification (MRV) frameworks, the necessary foundation for future carbon pricing systems. To date, Montenegro has made the most progress on carbon pricing, with an emissions trading system in force since 2020 covering the electricity and industrial sectors ( table 1).

Table 1. Evolution of carbon pricing and MRV in the Western Balkans

Can the carbon border adjustment mechanism encourage decarbonization?

With the EU proposal Carbon border adjustment mechanism (CBAM) On the horizon, the EU is changing the equation for its trading partners, suggesting countries introduce carbon pricing before 2026, otherwise their exports to the EU will be taxed for their untaxed carbon content in their native country. Given the proposed slow implementation of the mechanism, a suggested temporary exemption for linked electricity markets (see Article 2(7) of the latest available text of the draft CBAM Regulation) and its limited sectoral scope, the EU CBAM is not designed to harm trading partners, but rather aims to provide a common timeline and sectoral coverage for the implementation of carbon pricing and a broader climate action in trading partner countries.

One of the technical obstacles to implementing carbon pricing in WB6 relates to the characteristics of their electricity markets. Although significant progress has been made in improving regional connectivity between Western Balkan partners (notably via the Trans-Balkan Corridor), a regional energy market has not yet been created. With a fully integrated energy market within the BM6, these countries could better access cheaper and greener energy alternatives, balance resources and better diversify their energy mix. Partially monopolistic markets (with the largest supplier ranging from 37% market share in Albania to 100% in Kosovo) further make it difficult to create a level playing field for renewable energy by deterring new entrants and limiting competition. Wind and solar technologies, which currently represent only 3% of the region’s total energy supply, could particularly benefit from improving market conditions.

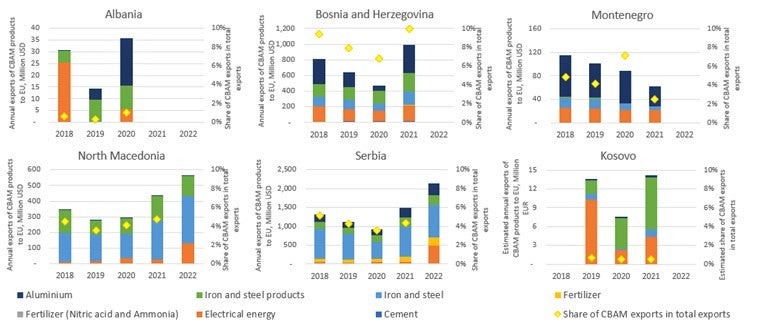

WB6 also faces mixed near-term impacts from carbon pricing and CBAM, and early movers in national carbon pricing may fear being worse off. The CBAM as proposed in December 2022 would cover between 1% and 10% of total exports per country (based on 2018-2022 data), or on average 4% across WB6 (Figure 1). Modeling carried out for Serbia shows that the macroeconomic impact of CBAM is expected to be small, as the decline in exports would be partially offset by the reallocation of labor and capital to growing low-carbon sectors. However, impacts are more targeted to carbon-intensive sectors such as ferrous metals, chemicals, non-metallic minerals, electricity supply and coal mining.

When it comes to carbon pricing, the results point in the same direction: macroeconomic impacts could remain minimal when tax revenues are spent productively (studies suggest that the impacts of EU-aligned carbon pricing in BM6 could range from -1.7% to +0.6% of GDP), but other policies will be needed to manage the impact on emissions-intensive sectors.

Note: Kosovo data includes EX1 exports only. The total value of exports potentially exposed is therefore underestimated in the graph.

Coordinated action at the regional level is needed to improve the price of fossil fuels

Carbon pricing will have significant benefits that go beyond EU alignment for BM6 and will be even more important under joint or coordinated implementation in the region. A regionally coordinated carbon pricing approach can take several forms. Coordinated price levels will help address carbon leakage issues, and moving forward as a group would allow BM6 countries to more quickly build capacity and share knowledge on the common building blocks of carbon pricing. However, for carbon pricing to be effective, compensatory pricing instruments will need to be phased out. This includes a refocusing of fossil fuel subsidies and reform of electricity tariffs. In addition, support measures are needed to further improve the availability and affordability of low-carbon technologies.

Aligning excise duties with the EU acquis can be an easy first step towards better price signals. Recently, some WB6 countries have introduced temporary reductions in excise duties on fossil fuels in response to high energy prices and inflation. However, in the future, the environmental cost of fuels should be better reflected, for example by aligning excise rates with the revised draft law. European directive on energy taxation (ETD), would bring BM6 more in line with the EU and would be a first step towards a stronger carbon pricing signal while MRV and other institutional direct carbon pricing capabilities are being developed. development.